Types of Education Loans for Indian Students

In India, there are various types of education loans available specifically designed to support Indian students in pursuing higher education. These loans aim to ease the financial burden associated with educational expenses and enable students to fulfill their academic aspirations.

What is an Education Loan?

An education loan, also known as a student loan, is a financial assistance program provided by banks, financial institutions, and government bodies to help students finance their higher education expenses. It is a specialized loan designed to cover the cost of tuition fees, accommodation, study materials, travel, and other related expenses.

Education loans are typically offered to students who are pursuing undergraduate, postgraduate, or vocational courses, both within India and abroad. These loans enable students from diverse financial backgrounds to access quality education without being hindered by the high costs associated with it.

How Does an Education Loan Work?

An education loan functions as a financial agreement between a student (the borrower) and a bank, financial institution, or government body (the lender). Here’s how an education loan typically works:

- Loan Application: The student applies for an education loan by submitting an application to the chosen lender. The application requires details such as the course being pursued, the educational institution, the loan amount required, and supporting documents such as admission letter, academic records, income proof, and identity/address proofs.

- Loan Approval and Disbursement: After evaluating the application, the lender assesses the borrower’s eligibility based on factors like academic performance, financial background, collateral, and credit history. Once approved, the loan amount is disbursed either directly to the educational institution or to the borrower’s bank account as per the agreed terms.

- Utilization of Funds: The disbursed loan amount is primarily intended to cover educational expenses, including tuition fees, accommodation costs, study materials, equipment, and other related expenses. The borrower is expected to utilize the funds for legitimate educational purposes only.

- Moratorium Period: Most education loans have a moratorium period, which is a grace period during which the borrower is not required to make any repayments. This period typically extends to the course duration and some additional months or years to allow the borrower to focus on their studies.

- Repayment: The repayment period begins either after the completion of the course or after the moratorium period ends, depending on the terms agreed upon. The borrower is required to start repaying the loan amount along with the accrued interest. Repayment can be done through equated monthly installments (EMIs) over a specified period, typically ranging from a few years to several years.

- Interest and Charges: Education loans incur interest charges, which can be either fixed or floating, depending on the terms agreed upon. The borrower is responsible for paying the interest along with the principal amount. Some loans may also have processing fees, prepayment charges, or other applicable charges, which should be carefully understood by the borrower.

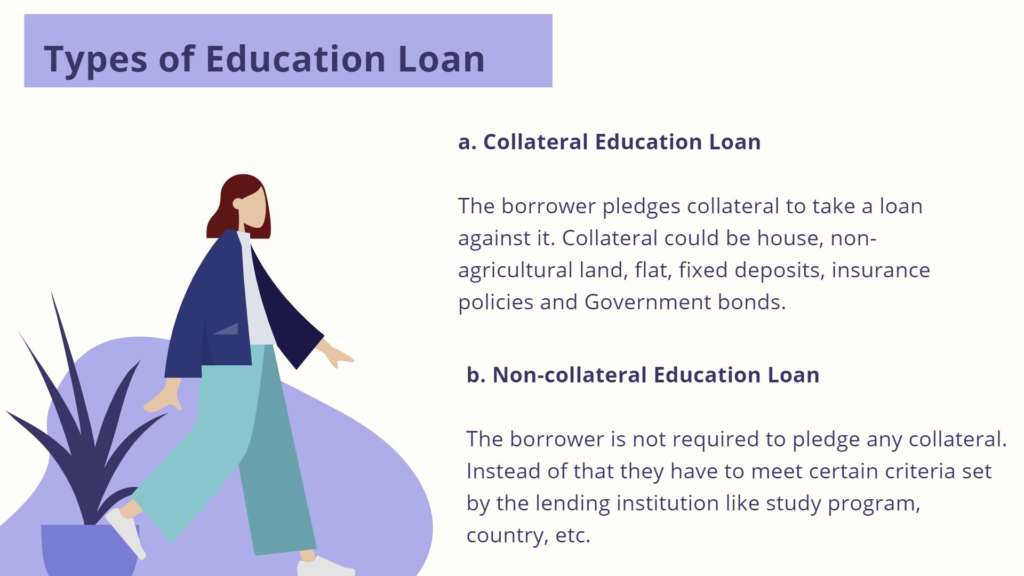

- Collateral and Guarantor: In some cases, depending on the loan amount and lender’s policies, collateral or a guarantor may be required as security for the loan. Collateral can be in the form of property, fixed deposits, or other valuable assets. A guarantor is someone who agrees to take responsibility for loan repayment if the borrower defaults.

Types of Education Loans in India

| Loan Type | Description |

| Undergraduate Education Loan | Designed for students pursuing a bachelor’s degree in India or abroad. Covers tuition fees, accommodation, study materials, and related costs. |

| Postgraduate Education Loan | For students pursuing higher studies after completing their bachelor’s degree. Covers expenses for master’s degrees, doctoral programs, etc. |

| Study Abroad Loan | Intended for students studying outside India. Covers tuition fees, living costs, travel, and other study-related expenses. |

| Vocational Education Loan | Tailored for students seeking specialized vocational training or skill development courses. Covers expenses for certificate or diploma courses. |

| Loan for Competitive Exams Coaching | Provides financial assistance for students preparing for competitive exams like engineering, medical, or civil services entrance exams. |

| Loan for Study Materials | Covers the cost of study materials such as books, laptops, software, and other equipment required for educational purposes. |

| Loan for Pre-Admission Expenses | Helps cover expenses incurred before admission, such as counseling fees, application fees, and exam fees. |

Undergraduate Education Loans

Undergraduate education loans are specifically designed to support students pursuing a bachelor’s degree in India or abroad. These loans help cover various expenses associated with undergraduate education. Here are some key features of undergraduate education loans:

- Loan Amount: The loan amount for undergraduate education loans can vary depending on the course and institution. Banks typically offer loans ranging from a few lakhs to several lakhs or even crores of rupees.

- Eligibility: To be eligible for an undergraduate education loan, students are generally required to meet certain criteria related to academic performance, admission to a recognized institution, and the financial background of the borrower or their parents/guardians.

- Expenses Covered: Undergraduate education loans typically cover tuition fees, examination fees, library fees, laboratory fees, hostel or accommodation charges, study materials, laptops, and other related expenses.

- Moratorium Period: Most education loans provide a moratorium period, which is a grace period during which the borrower is not required to make any repayments. This period generally extends to the course duration and a few months after completion or finding employment.

- Interest Rate: The interest rates for undergraduate education loans can be either fixed or floating. They are influenced by factors such as the loan amount, repayment period, and the policies of the lending institution.

- Repayment: The repayment period for undergraduate education loans usually starts after the moratorium period ends or the completion of the course, depending on the terms agreed upon. Repayment can be done through equated monthly installments (EMIs) over a specified period.

- Collateral and Guarantor: Depending on the loan amount, collateral or a guarantor may be required as security. Collateral can be in the form of property, fixed deposits, or other valuable assets. A guarantor is someone who takes responsibility for loan repayment if the borrower defaults.

Education Loans for Professionals and Graduates

Education loans for professionals and graduates are specialized loan programs designed to support individuals who have completed their undergraduate studies and are looking to pursue further education or professional courses. These loans cater to a wide range of postgraduate, professional, and skill development programs.

Career Education Loan

A career education loan is a specialized type of loan that aims to support individuals who are looking to enhance their skills, acquire new qualifications, or undergo career-oriented training programs. These loans are specifically designed to cover the expenses related to career development courses and vocational training.

Eligibility

The eligibility for an education loan typically includes factors such as:

- Admission to a recognized educational institution.

- Meeting the age criteria set by the lender.

- Being an Indian citizen or meeting specific residency criteria.

- Providing necessary documents like admission letter, academic records, identity/address proofs.

- Showing the ability to repay the loan, including creditworthiness and income stability.

Documents Required

The documents required for an education loan may vary depending on the lending institution and the specific loan program. However, here are some common documents that are typically requested:

- Completed loan application form.

- Proof of identity (such as Aadhaar card, passport, or PAN card).

- Proof of address (such as Aadhaar card, utility bills, or rental agreement).

- Proof of admission to the educational institution (admission letter or offer letter).

- Academic documents (mark sheets, certificates, or degrees).

- Cost of study document (fee structure or estimate from the institution).

- Income proof of co-applicant or guarantor (salary slips, income tax returns, or bank statements).

- Bank statements of the borrower or co-applicant.

- Passport-size photographs.

- Any additional documents required by the lending institution, such as collateral documents or loan agreement.

Which Bank Provides Loan Easily?

Multiple banks and financial institutions provide education loans with varying eligibility criteria and ease of approval. However, it is important to note that the ease of getting a loan may depend on several factors, including the borrower’s creditworthiness, the loan amount, the chosen educational institution, and the specific loan program.

Some popular banks in India that are known for providing education loans include State Bank of India (SBI), HDFC Bank, ICICI Bank, Punjab National Bank (PNB), Canara Bank, and Axis Bank.

It is recommended to research and compare the offerings, interest rates, repayment terms, and customer reviews of different banks to find the one that best suits your needs and offers a convenient loan application process.

Top Education Loan for Girl Students in India

| Bank/Financial Institution | Loan Scheme | Key Features |

| State Bank of India (SBI) | SBI Scholar Loan for Girl Students | Special loan scheme for girls pursuing higher education in India or abroad. |

| Axis Bank | Axis Bank Education Loan for Women | Designed to support female students pursuing higher education in India or overseas. |

| Punjab National Bank (PNB) | PNB Saraswati Loan Scheme | Exclusive loan program for meritorious girl students pursuing higher education in India. |

| HDFC Bank | HDFC Bank Vidya Lakshmi Education Loan Scheme for Girl Child | Offers loans for education to deserving girl students. |

| Canara Bank | Canara Bank’s Prerna Loan Scheme | Provides financial assistance to girl students for pursuing higher education in India. |

| Indian Bank | Indian Bank’s Ind-Swift Student Education Loan Scheme | A loan scheme for girls pursuing professional and technical courses. |

FAQs

Q: What is the maximum loan amount I can get for an education loan?

A: The maximum loan amount for an education loan depends on various factors such as the course you are pursuing, the institution, and the lending institution’s policies. Generally, loans can range from a few lakhs to several crores of rupees.

Q: What is the interest rate for education loans?

A: The interest rates for education loans can vary depending on the lending institution, loan amount, repayment period, and other factors. Interest rates can be either fixed or floating, and it is advisable to check with different banks or financial institutions to compare rates and choose the most favorable option.

Q: Do I need a co-borrower or guarantor for an education loan?

A: The requirement for a co-borrower or guarantor depends on the loan amount and the policies of the lending institution. Higher loan amounts may require a co-borrower or guarantor as additional security.

Q: When do I have to start repaying my education loan?

A: Repayment typically starts after the moratorium period, which is the grace period provided by the lender. The moratorium period usually extends to the course duration and a few months after completion or finding employment. However, some lenders may offer flexible repayment options, so it’s essential to clarify the repayment terms with the lending institution.

Q: Can I get a tax benefit on education loan interest payments?

A: Yes, you may be eligible for tax benefits under Section 80E of the Income Tax Act, 1961, for the interest paid on education loans. The deduction is available for a maximum of eight consecutive years or until the interest is fully repaid, whichever is earlier. It’s advisable to consult a tax professional for accurate guidance regarding tax benefits.

Q: What happens if I am unable to repay my education loan?

A: If you are unable to repay your education loan, it is crucial to communicate with the lender immediately. Depending on the circumstances, you may be eligible for loan restructuring, deferment, or other repayment options. Defaulting on loan payments can have serious consequences on your credit score and future financial prospects, so it’s important to address the issue proactively and seek guidance from the lending institution.