Requirements

- 12th Pass Certificate

- Minumum 50% Marks

- Transfer Certificate

- Addhar Card

- Photos

Features

- Skill to Learn Commerce Course

- More then 100 Specialisation

- Online mode Exam

- Online Mode Study and E-Learning Material

- 0% EMI Option

- Scholarships

Online MBA in Finance

The MBA in Finance program equips students with in-depth studies related to the various aspects of finance similar as management, control, and evaluation of collection, investment, and resources. MBA in Finance is a two-year post-graduate degree that prepares candidates for various management functions in finance. Various specializations of finance base on the administration and controller of the financial resources of a company.

Master of Business Administration (MBA) in Finance offers a broad range of openings to applicants be they fresher or endured in the financial humankind. The analysis and complex of money, stocks, as well as other financial things are known as finance.

Key Highlight for MBA in Finance

| Key Highlights | Description |

|---|---|

| Duration | 2 years (full-time) |

| Eligibility | Bachelor’s degree in any discipline with a minimum aggregate score of 50% (may vary depending on the institution) |

| Admission Process | Entrance exam (such as CAT, XAT, GMAT, etc.), followed by Group Discussion and Personal Interview |

| Core Subjects | Financial Accounting, Corporate Finance, Financial Statement Analysis, Investment Management, Financial Markets and Institutions, Risk Management, and Derivatives |

| Elective Subjects | Advanced Corporate Finance, Behavioral Finance, Financial Modeling, Mergers and Acquisitions, International Finance, and others |

| Career Opportunities | Financial Analyst, Investment Banker, Asset Manager, Equity Research Analyst, Credit Analyst, Corporate Finance Manager, Treasury Manager, and others |

| Salary Range | INR 6-25 lakhs per annum (depending on the job role and institution) |

| Top Recruiters | Investment Banks (such as Goldman Sachs, JP Morgan, Morgan Stanley), Financial Services companies (such as American Express, Citibank, HSBC), Consulting firms (such as McKinsey, Bain, BCG), and others |

Why Study MBA in Finance Management?

MBA in Finance Management concentrates additionally on finance and its management and the program will help candidates make high knowledge of finance including zones like fintech, economics, and investment. It similarly allows you to take on new challenges and successfully overcome them. Here are some of the topmost reasons to chase an MBA in Finance Management

- Diverse Range of Jobs: – Every industry in the demand requires professionals who have knowledge of cash flow, investment details and etc. There’s no commodity that doesn’t engage financial experts. Thus, finance is a sphere that provides ample job openings in various sections of the market.

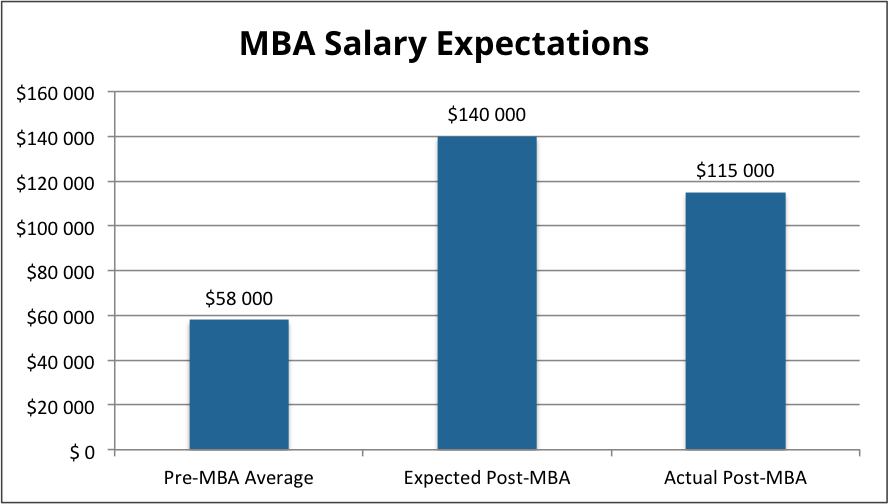

- Higher Salary: – MBA in Finance graduates gets more payment as compared to utmost other MBA specializations. The pay increases as one attains the necessary expertise and experience.

- In- depth Knowledge: – Applicants get general as well as higher knowledge of finance. The course class involves management simulations, projects, and internships that help Applicants to grow holistically. They get openings to network well through cooperation, public commerce, and cooperative association.

Entrepreneurial Insight The program provides knowledge of how to exercise financial resources optimally and address them constructively. Thus, those who wish to start a new business will no way face hurdles in gathering finances if they finish MBA in Finance Management.

Who Study MBA in Finance Distance Education

MBA in Finance is a popular course for students who wish to pursue a career in finance and management. Distance education in MBA in Finance is ideal for individuals who are unable to attend regular classes due to work commitments or personal responsibilities. Here are some individuals who may choose to study MBA in Finance through distance education:

- Working Professionals: Distance education in MBA in Finance is ideal for working professionals who wish to enhance their skills and knowledge in finance and management while continuing to work. The flexibility of the program allows them to balance work and study.

- Entrepreneurs: Individuals who wish to start their own business or already own a business may choose to study MBA in Finance through distance education to acquire the necessary skills and knowledge to manage their finances effectively.

- Graduates: Recent graduates who wish to pursue a career in finance and management may choose to study MBA in Finance through distance education to gain the necessary skills and knowledge.

- Career Changers: Individuals who wish to switch their careers to finance and management may choose to study MBA in Finance through distance education to acquire the necessary skills and knowledge for the new field.

When to do an MBA Finance Course?

Deciding when to pursue an MBA in Finance course depends on various factors such as your career goals, work experience, and financial situation. Here are some general guidelines to help you decide when to pursue an MBA in Finance:

- Work Experience: Many MBA programs prefer candidates with work experience, as it helps them bring real-world experience to the classroom. Typically, candidates with 2-3 years of work experience are considered for admission to MBA programs. However, this may vary depending on the institution.

- Career Goals: If you are interested in pursuing a career in finance or related fields such as investment banking, equity research, or corporate finance, then an MBA in Finance may be beneficial. MBA in Finance can provide you with a deep understanding of financial concepts, financial markets, and investment strategies.

- Financial Situation: Pursuing an MBA in Finance can be expensive. It’s important to consider your financial situation and the potential return on investment (ROI) of the program. You may want to assess the potential salary range and job opportunities after completing the program.

- Timing: If you are planning to pursue an MBA in Finance, it’s important to time it correctly. You should consider the application deadlines of the institutions you are interested in, as well as the timing of the entrance exams. You may also want to consider your personal commitments and availability to pursue the program.

Types of MBA in Finance

| Type of MBA in Finance | Description |

|---|---|

| Full-Time MBA in Finance | A traditional, in-person MBA program that typically lasts for 2 years. It includes classroom lectures, case studies, internships, and networking opportunities. This program is best suited for students who want to take a break from work and pursue a full-time MBA. |

| Part-Time MBA in Finance | A program designed for working professionals who want to continue their job while pursuing an MBA. The duration of the program may vary from 2-4 years, and classes are held in the evenings or on weekends. This program allows students to apply the concepts learned in class to their work in real time. |

| Executive MBA in Finance | A program designed for mid-to-senior level professionals with 8-10 years of work experience. It includes advanced coursework, executive coaching, and networking opportunities. This program focuses on leadership and strategic management skills. |

| Online MBA in Finance | A program delivered entirely online, allowing students to pursue their MBA from anywhere in the world. This program includes live or recorded lectures, online discussion forums, and assignments. Online MBA programs offer flexibility and convenience for students who cannot attend traditional in-person programs. |

| Distance MBA in Finance | Similar to the online MBA, distance MBA programs are delivered through correspondence, such as email, mail, or recorded lectures. These programs offer flexibility and convenience, but students may miss out on some networking opportunities available in traditional in-person MBA programs. |

MBA Finance vs MBA Marketing

| Aspect | MBA Finance | MBA Marketing |

|---|---|---|

| Focus | Emphasis on financial analysis, investment management, and corporate finance | Emphasis on consumer behavior, market research, and advertising |

| Core Courses | Financial Management, Financial Reporting and Analysis, Investments, Derivatives, Corporate Finance | Marketing Management, Consumer Behavior, Brand Management, Advertising, Sales Management |

| Career Options | Investment Banking, Corporate Finance, Private Equity, Asset Management, Risk Management | Brand Management, Product Management, Market Research, Advertising, Sales Management |

| Skills Developed | Analytical and quantitative skills, Financial modeling, Risk management, Strategic decision-making | Creative and persuasive skills, Market research, Communication, Strategic decision-making |

| Salary Potential | High average salary due to the specialized skills required, such as investment banking | Average salary is lower compared to finance, but can have a high potential in certain sectors like branding or advertising |

| Job Outlook | Generally stable with strong demand in financial services and related industries | Can vary based on the industry and market trends, but demand is typically strong in industries such as consumer goods, tech and retail |

| Industry Coverage | Banking, Investment, Insurance, Consulting and other finance-related industries | Advertising, Media, Retail, Consumer Goods, Consumer services and other marketing-related industries |

MBA in Finance: Admission Process

The admission process for an MBA in Finance program may vary depending on the institution. However, here are some general steps that are commonly involved:

- Meet Eligibility Criteria: Candidates are required to meet the eligibility criteria for the program, which may include a bachelor’s degree in any discipline, minimum work experience, and a qualifying score on an entrance exam such as GMAT or GRE.

- Entrance Exam: Candidates may be required to take an entrance exam such as GMAT or GRE, which test the candidate’s aptitude for business studies. Some institutions may also accept scores from other entrance exams such as CAT, XAT, MAT, or CMAT.

- Application: Candidates need to complete the application process, which typically involves submitting an online application form, academic transcripts, and test scores. Some institutions may also require candidates to submit letters of recommendation, essays, or a statement of purpose.

- Group Discussion and Personal Interview: Shortlisted candidates may be invited for a group discussion or personal interview, which helps the institution assess the candidate’s communication skills, analytical abilities, and suitability for the program.

- Admission Offer: Candidates who successfully complete the admission process may receive an admission offer from the institution. Candidates are required to pay the admission fee and confirm their acceptance of the offer.

MBA Finance Eligibility

The eligibility criteria for an MBA in Finance may vary depending on the institution. However, here are some general eligibility criteria:

- Education: Candidates should have a bachelor’s degree in any discipline from a recognized university. Some institutions may require a minimum percentage or grade in the bachelor’s degree program.

- Work Experience: Some institutions may require candidates to have a work experience ranging from 0-2 years to 5-7 years, depending on the type of MBA in Finance program.

- Entrance Exam: Candidates may be required to take an entrance exam such as GMAT or GRE, which tests the candidate’s aptitude for business studies. Some institutions may also accept scores from other entrance exams such as CAT, XAT, MAT, or CMAT.

- English Language Proficiency: Candidates from non-English speaking countries may be required to provide proof of English language proficiency through TOEFL, IELTS, or other accepted tests.

MBA Finance Entrance Exams

| Exam | Conducting Body | Sections | Score Validity |

| CAT (Common Admission Test) | IIMs (Indian Institutes of Management) | Verbal Ability & Reading Comprehension, Data Interpretation & Logical Reasoning, and Quantitative Ability | 1 year |

| XAT (Xavier Aptitude Test) | XLRI Jamshedpur | Verbal Ability & Reading Comprehension, Decision Making, Quantitative Ability & Data Interpretation, General Awareness | 1 year |

| GMAT (Graduate Management Admission Test) | GMAC (Graduate Management Admission Council) | Analytical Writing Assessment, Integrated Reasoning, Quantitative Reasoning, Verbal Reasoning | 5 years |

| CMAT (Common Management Admission Test) | NTA (National Testing Agency) | Quantitative Techniques and Data Interpretation, Logical Reasoning, Language Comprehension, General Awareness | 1 year |

| MAT (Management Aptitude Test) | AIMA (All India Management Association) | Language Comprehension, Mathematical Skills, Data Analysis & Sufficiency, Intelligence & Critical Reasoning, Indian & Global Environment | 1 year |

| SNAP (Symbiosis National Aptitude Test) | Symbiosis International (Deemed University) | General English, Quantitative, Data Interpretation & Data Sufficiency, Analytical & Logical Reasoning | 1 year |

MBA in Finance Distance Learning College and Fees

| College | Location | Fees (approx.) |

|---|---|---|

| Indira Gandhi National Open University (IGNOU) | New Delhi | Rs. 31,500 |

| Symbiosis Centre for Distance Learning | Pune | Rs. 50,000 |

| Amity University Online | Noida | Rs. 1,28,800 |

| ICFAI University | Hyderabad | Rs. 65,000 |

| Annamalai University | Tamil Nadu | Rs. 28,000 |

| Madurai Kamaraj University | Tamil Nadu | Rs. 40,000 |

| Narsee Monjee Institute of Management Studies (NMIMS) Global Access School for Continuing Education | Mumbai | Rs. 1,70,000 |

| Pondicherry University | Puducherry | Rs. 34,600 |

| SMU-DE | Manipal | Rs. 53,000 |

| Bharathiar University | Tamil Nadu | Rs. 35,000 |

Top Government MBA in Finance Colleges in India and Fees

| College | Location | Approximate Fees (in INR) |

|---|---|---|

| Indian Institute of Management Ahmedabad (IIMA) | Ahmedabad, Gujarat | 23,00,000 |

| Indian Institute of Management Bangalore (IIMB) | Bangalore, Karnataka | 23,00,000 |

| Indian Institute of Management Calcutta (IIMC) | Kolkata, West Bengal | 22,00,000 |

| Indian Institute of Management Lucknow (IIML) | Lucknow, Uttar Pradesh | 19,25,000 |

| Indian Institute of Technology Delhi (IITD) – Department of Management Studies | New Delhi | 9,60,000 |

| Indian Institute of Technology Kharagpur (IITKGP) – Vinod Gupta School of Management | Kharagpur, West Bengal | 10,00,000 |

| Department of Management Studies, Indian Institute of Technology (IIT) Madras | Chennai, Tamil Nadu | 10,00,000 |

| Faculty of Management Studies (FMS), University of Delhi | New Delhi | 1,00,000 (approx.) |

| Shailesh J Mehta School of Management, Indian Institute of Technology Bombay (IITB) | Mumbai, Maharashtra | 8,50,000 |

MBA Finance Syllabus

Year I | |

| Macroeconomics and Business Environment | Financial Functions |

| Managerial Economics | Financial Management |

| Valuation of Bond and Shares | Cost of Capital |

| Advanced Marketing | Leverage |

| Introduction to Time, Value and Money | Cost of Different Sources in Finance |

| Macroeconomics | Capital Structure: Introduction, Features, & Factors Affecting Capital Structures |

Year II | |

| Theories of Capital Structure | Capital Budgeting |

| Portfolio Analysis | Risk Analysis in Capital Budgeting |

| Money and Capital Markets | Capital Rationing |

| Statistics for Business | Working Capital Management |

| Dividend Decisions | Cash Management |

MBA Finance Subjects

| MBA in Finance Syllabus: Semester I | MBA in Finance Syllabus: Semester II |

| Macroeconomics and Business Environment | Fundamentals of Marketing Management |

| Managerial Economics | Business Laws |

| Fundamentals of Accounting | International Business |

| Direct and Indirect Taxes | Operations Research |

| Statistical Techniques for Managerial Decisions | Managerial Accounting |

| Management Information System | Financial Management |

| Computer Applications in Business | Research Methodology and Project Work |

| MBA in Finance Syllabus: Semester III | MBA Finance Syllabus: Semester IV |

| Money Market and Capital Market | Indian Financial Institutions and Markets |

| Business Strategy | Risk Management: Tools and Applications |

| Business Ethics and Corporate Governance | International Accounting |

| International Financial Management | Mergers and Acquisitions |

| Security Analysis and Portfolio Management | Dissertation |

MBA in Finance Important Books

| Book | Author(s) | Publisher |

|---|---|---|

| Financial Management: Theory & Practice | Eugene F. Brigham and Michael C. Ehrhardt | Cengage Learning |

| Fundamentals of Financial Management | Eugene F. Brigham and Joel F. Houston | Cengage Learning |

| Corporate Finance | Jonathan Berk and Peter DeMarzo | Pearson |

| Security Analysis and Portfolio Management | Donald E. Fischer and Ronald J. Jordan | Pearson |

| Options, Futures, and Other Derivatives | John C. Hull | Pearson |

| Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions | Joshua Pearl and Joshua Rosenbaum | Wiley |

| The Intelligent Investor | Benjamin Graham | Harper Business |

| A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing | Burton Malkiel | W. W. Norton & Company |

| The Warren Buffett Way: Investment Strategies of the World’s Greatest Investor | Robert G. Hagstrom | Wiley |

MBA Finance-Related Courses

| Course | Description | Duration |

|---|---|---|

| Chartered Financial Analyst (CFA) | Focuses on investment analysis and portfolio management, and includes three levels of exams | 2-5 years |

| Certified Financial Planner (CFP) | Covers topics such as investment planning, insurance planning, retirement planning, and tax planning | 6-18 months |

| Financial Risk Manager (FRM) | Focuses on managing financial risks in various industries, including banking and finance, insurance, and energy | 1-2 years |

| Certified Treasury Professional (CTP) | Covers topics such as cash and treasury management, risk management, and financial management | 6-12 months |

| Doctor of Philosophy (PhD) in Finance | Focuses on conducting original research in finance, and includes coursework in finance theory, statistical methods, and research methodology | 3-5 years |

Internship for MBA in Finance

| Internship | Company | Stipend per month (INR) |

| Investment Analysis | Torre Capital | 7000-10000 |

| Insurance Policy | Rozgaar India | 10000-15000 |

| Financial Analysis | Pitchkrafts | 8000 |

| Finance Management | Nanjil Anand Foundation | Unpaid |

| Financial Sales | WeMakeScholars | 12000-17000 |

| Policy/Insurance Advisory | Rozgaar India | 10000 |

MBA in Finance Jobs and Salary

| Job Position | Job Description | Average Salary (per annum) |

|---|---|---|

| Financial Analyst | Analyze financial data to create financial models, forecast future trends, and develop financial strategies | Rs. 6-8 lakhs |

| Investment Banker | Help companies raise capital through various means, including IPOs and private placements | Rs. 10-20 lakhs |

| Risk Manager | Identify, evaluate, and mitigate financial risks for companies | Rs. 8-12 lakhs |

| Corporate Treasurer | Manage a company’s financial risks and liquidity, and ensure that it has enough cash to meet its obligations | Rs. 10-15 lakhs |

| Financial Manager | Oversee a company’s financial operations, including budgeting, forecasting, and financial analysis | Rs. 8-12 lakhs |

| Management Consultant | Provide expert advice to companies on various management-related issues, including financial strategies | Rs. 8-15 lakhs |

Top Recruiter For MBA Finance

| Top Recruiters | Job Titles |

|---|---|

| Goldman Sachs | Financial Analyst, Investment Banker |

| J.P. Morgan | Portfolio Manager, Risk Analyst |

| Citigroup | Financial Planner, Relationship Manager |

| Morgan Stanley | Equity Research Analyst, Wealth Advisor |

| Bank of America | Credit Analyst, Corporate Banker |

| Wells Fargo | Financial Consultant, Treasury Analyst |

| Barclays | Investment Banking Associate, Risk Manager |

| UBS | Asset Manager, Private Wealth Advisor |

| Credit Suisse | Mergers and Acquisitions Analyst, Trader |

| Deutsche Bank | Equity Sales, Fixed Income Analyst |

Preparation Tips for MBA Finance Course

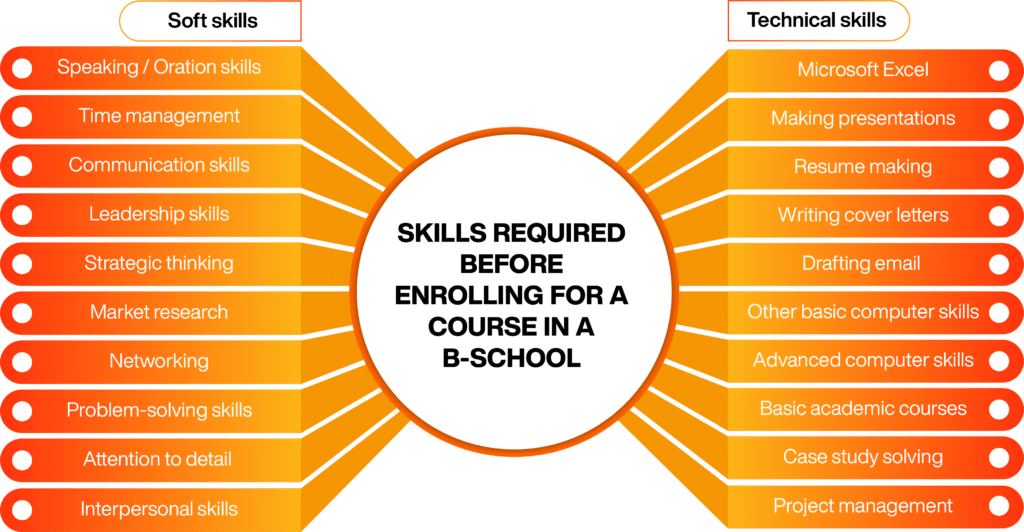

Preparing for an MBA in Finance requires a combination of academic readiness, industry knowledge, and professional development. Here are some tips to help you prepare for an MBA in Finance:

- Strengthen your foundation: Ensure you have a solid understanding of fundamental finance concepts such as accounting, financial statements, investment analysis, and corporate finance. Review basic finance textbooks or online resources to refresh your knowledge.

- Develop quantitative skills: Finance involves extensive data analysis and numerical calculations. Strengthen your quantitative skills by practicing mathematical concepts, statistics, and financial modeling. Familiarize yourself with tools like Excel and financial software commonly used in the industry.

- Stay updated with industry trends: Keep up with current financial news, market trends, and economic developments. Read financial publications, follow reputable financial websites, and engage in discussions to stay informed about the latest happenings in the finance industry.

- Gain practical experience: Seek opportunities to gain practical experience in finance-related roles. Consider internships, part-time jobs, or volunteering in finance departments of organizations. Practical exposure will provide you with real-world insights and help you apply theoretical concepts.

- Network with professionals: Build a network of professionals in the finance industry. Attend networking events, join industry associations, and leverage online platforms like LinkedIn to connect with professionals and gain insights into the industry. Networking can open doors to internship opportunities, mentorship, and potential job prospects.

- Develop strong analytical and problem-solving skills: Finance professionals need to analyze complex data, identify patterns, and solve financial problems. Enhance your analytical and problem-solving skills by practicing case studies, participating in business competitions, and engaging in financial research projects.

- Enhance communication and presentation skills: Effective communication is crucial in the finance industry. Develop strong verbal and written communication skills, as well as presentation abilities. Engage in public speaking opportunities, join communication-focused clubs or organizations, and practice presenting financial analyses or reports.

- Familiarize yourself with finance tools and software: Become proficient in using financial tools and software such as financial modeling tools, data analysis software, and financial management systems. Familiarity with these tools will enhance your efficiency and productivity in finance-related tasks.

- Prepare for entrance exams: Some MBA programs require entrance exams such as the GMAT (Graduate Management Admission Test) or GRE (Graduate Record Examination). Familiarize yourself with the format of the exam, practice sample questions, and consider enrolling in preparatory courses if necessary.

- Reflect on your career goals: Take time to understand your career goals within the finance industry. Research different finance career paths such as investment banking, corporate finance, asset management, or financial consulting. Understand the skills and qualifications required for your desired career trajectory and align your preparation accordingly.

Skills That Make You the Best MBA Finance Graduate

| Skills | Description |

|---|---|

| Financial Analysis | Ability to analyze financial data, interpret statements, and make recommendations based on financial performance. |

| Investment Management | Proficiency in evaluating investment options, conducting risk assessments, and developing investment strategies. |

| Financial Modeling | Skill in constructing financial models to assess business scenarios, conduct valuation analyses, and make informed decisions. |

| Risk Management | Understanding of risk assessment, risk mitigation strategies, and the ability to develop risk management frameworks. |

| Corporate Finance | Knowledge of financial decision-making in corporate settings, including capital budgeting, cost of capital, and financial planning. |

| Strategic Planning | Ability to align financial goals with overall business strategy, contribute to long-term planning, and support strategic decision-making. |

| Data Analysis | Proficiency in utilizing data analysis tools and techniques to derive insights, identify trends, and support evidence-based decision-making. |

| Communication Skills | Strong oral and written communication skills to present complex financial information, communicate effectively with stakeholders, and influence decision-makers. |

| Leadership Abilities | Capability to lead teams, manage projects, and drive financial initiatives within organizations. |

| Ethical Decision-Making | Commitment to ethical standards and the ability to make sound financial decisions in accordance with ethical principles. |